|

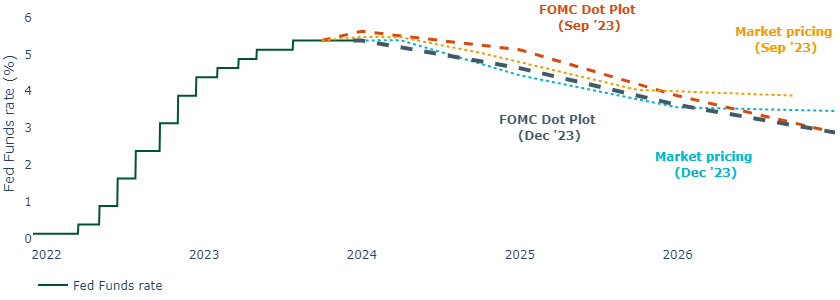

As expected, the Fed left the Fed Funds Rate at a range of 5.25% to 5.5%. However, for the first time since the hiking cycle began, it adjusted its “dot plot” to reflect a more dovish set of projections than the previous quarter. In our view, this marks the apex of the rate cycle.

The Fed’s median projection pencils in 75bp of cuts in 2024 (or three 25bp cuts). This is slightly more dovish than our current base case for two cuts. Either way, we currently suspect the first cut will arrive during the summer.

All eyes are on the start of the rate-cutting cycle

Since raising rates in 2022, every quarterly “dot plot” had been more hawkish than the last. However, today’s median projections were more dovish than they were in September (Figure 1). The committee pencilled in three cuts for 2024, roughly in line with current market pricing.

Figure 1: We have likely hit the apex of the rate cycle

Source: Federal Reserve, Bloomberg, Insight, December 2023

The Fed amended its policy statement to note that “growth of economic activity has slowed” and that inflation “has eased over the past year”.

The Fed updated its quarterly economic projections to reflect lower near-term GDP growth and lower inflation than it projected in September. For 2024, it lowered its GDP estimate from 1.5% to 1.4% and reduced its inflation estimates marginally.

Easing inflation and labor market conditions are taking pressure off the Fed

Continuing disinflationary pressures, as highlighted in this week’s CPI report, has offered the Fed room to maneuver. Further, there are signs that rate hikes are loosening the labor market.

For example, there are now 1.4 job openings for every unemployed worker, down from a post-pandemic peak of two.

The “quits rate” tells a similar story. Employees tend to resign when they are confident of achieving superior employment elsewhere, so a decrease in the rate indicates a less robust labor market. (Figure 2).

Figure 2: The labor market is loosening, but a “soft landing” could be in the cards

Source: Bureau of Labor Statistics, NBER, Insight, Bloomberg, December 2023

If the Fed can bring inflation down without these measures deteriorating much further, it strongly improves the central bank’s prospect of achieving a “soft landing” and avoiding a recession.

Nonetheless, the Fed remains cautious of easing financial conditions too quickly

Chair Powell offered a degree of caution and looked to prevent markets getting too ahead of themselves in pricing lower rates. He stated “it’s natural to look at the progress that has been made”, but “inflation is still too high, ongoing progress … is not assured and the path forward is uncertain”.

Although Powell stated that further rate hikes were “not likely”, he noted the committee did not want to take them entirely “off the table” and the central bank is “prepared to tighten further if appropriate”. As such, the committee’s statement retained its reference to “determining the extent of any additional policy firming that may be appropriate…”

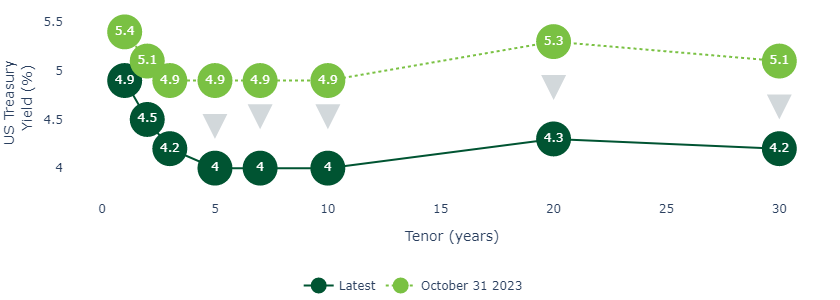

The committee appears cognizant of how far financial conditions have eased since the last FOMC meeting at the start of November. Since then, long-dated Treasury yields (upon which most lending rates in the real economy are based) have fallen by up to 90bp. The central bank is keen to prevent conditions from undermining its progress on inflation.

Figure 3: Falling long-dated yields demonstrate easing financial conditions

Source: Bloomberg, Insight, December 2023

We do not expect to see rate cuts until the summer

We believe that two rate cuts by the end of 2024 is a reasonable base case. However, we do not expect to see any activity until the summer, given our view that inflation will continue moderating (while remaining above-target) during the first half of the year.

There are risks around the outlook. Resilient inflation could justify a longer pause (or a hike if inflation were to reaccelerate) while a recession may call for an earlier and faster pace of rate cuts.

Nonetheless, we suspect economic conditions are falling into place for the Fed. Inflation may have been the grinch that stole the last two Christmases, but seasonal cheer may be more warranted this holiday season.

United States

United States