|

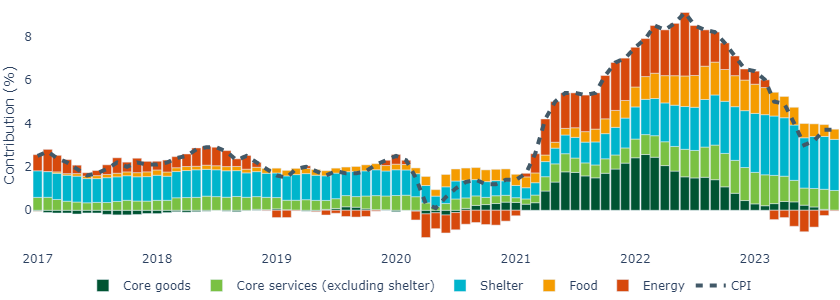

Shelter and energy were the key drivers

Figure 1: Energy CPI has continued to pick up

Source: Bureau of Labor Statistics, Insight, October 2023

The largest positive contributor to the monthly increase was shelter, which rose 0.6% month-on-month (its largest monthly print since February). However, we do not expect this to be a trend, at least in the near term, given its calculation methodology, which causes it to severely lag private rental indices by several months. On a year-on-year basis, shelter inflation is still easing and we expect that trend to continue (Figure 2).

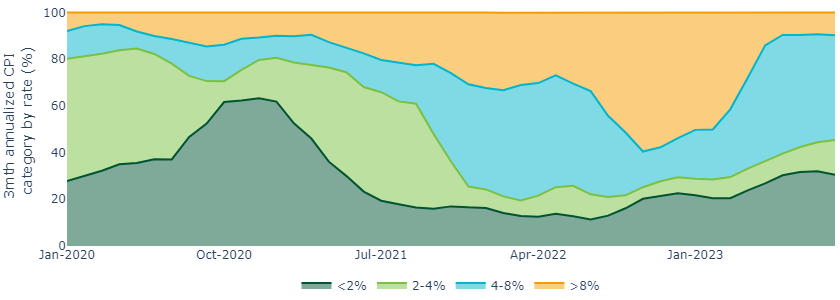

Figure 2: Shelter surprised to the upside on a month-on-month basis, but is still easing year-on-year

Source: Bureau of Labor Statistics, Bloomberg, Insight, October 2023

The largest negative contributors this month were used vehicles and durable goods categories such as apparel.

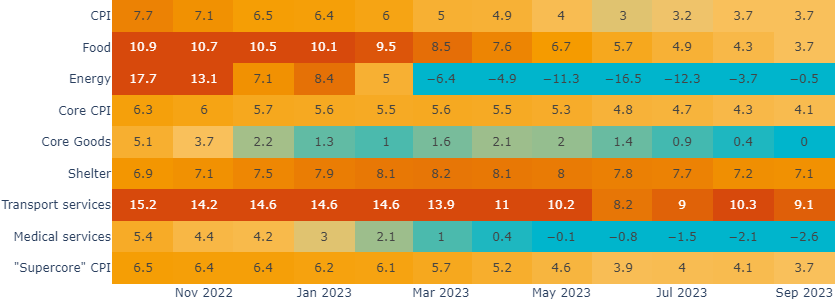

Price pressures are narrowing from a momentum perspective

We consider the 3-month annualized growth rate to be a good indicator of momentum. By this metric, headline CPI is running at 4.9% and Core CPI at 3.1%, down from 10% and 6% respectively last summer.

Around this time last year, more than half of the CPI index (by combined weight) was growing at 8% or above on a 3-month annualized basis. Today, that share is below 10%. Encouragingly, almost half of the index is now growing at 4% or lower on a 3-month annualized basis (Figure 3).

Figure 3: There are signs of broader disinflation

Source: Bureau of Labor Statistics, Insight, October 2023

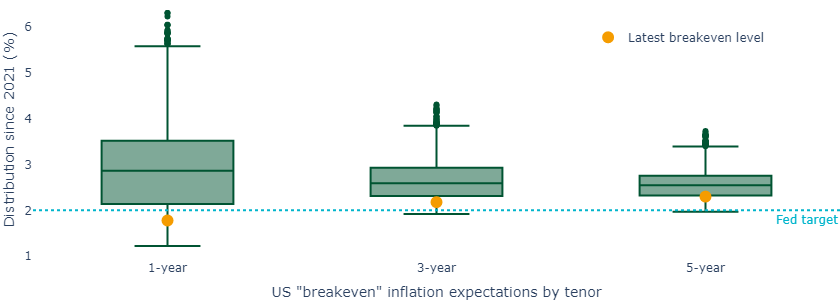

The Fed is succeeding in controlling near-term inflation pricing

Market-based measures of inflation expectations remain well-anchored, at least for the near-term. Inflation “breakeven” expectations1 1-year from now are as low as 1.3%, significantly below the Fed’s target, suggesting that investors are confident that the Fed will be able to tame inflation. Out to 5-years, breakevens are also generally trading below their interquartile ranges (represented by the green boxes in Figure 4) since 2021 (when inflation began to accelerate).

Figure 4: The Fed has successfully anchored near-term inflation expectations

Source: Bloomberg, Insight, October 2023. The boxes represent median and inter-quartile ranges. The whiskers stretch out up to an additional 1.5x the interquartile above / below the box (bounded by the largest / smallest values within the range). Additional values outside the whiskers are outliers.

The overall picture remains disinflationary, but upside risks remain

Near-term upside inflation risks cannot be ruled out. The “easy wins” from base effects are now behind us. Elsewhere, from next month, health insurance CPI (which is based on an annual calculation) will reset, going from a persistent negative contributor to a positive contributor for the next 12 months.

Although there may be more volatility in the upcoming CPI reports, fundamentally, the picture remains disinflationary in our view. While we cannot fully rule out one more rate hike by the end of the year, we expect the Fed will remain cautious given significant tightening of financial conditions over the last month.

United States

United States