As expected, the fed made no changes to monetary policy. It confirmed that rate hikes are no longer part of the conversation but cautioned rate cuts are not yet on the agenda either.

The FOMC statement included more changes from the previous meeting than usual, indicating we are at an inflection point.

On one hand, it mentioned the Fed’s “employment and inflation goals are moving into better balance” and softened its hawkish forward-looking language from “any additional firming” to the more neutral “any adjustments…”.

On the other hand, the members of the committee noted the need for “greater confidence that inflation is moving sustainably toward 2%” before committing to rate cuts.

The Fed will seriously consider slowing quantitative tightening (QT) in March

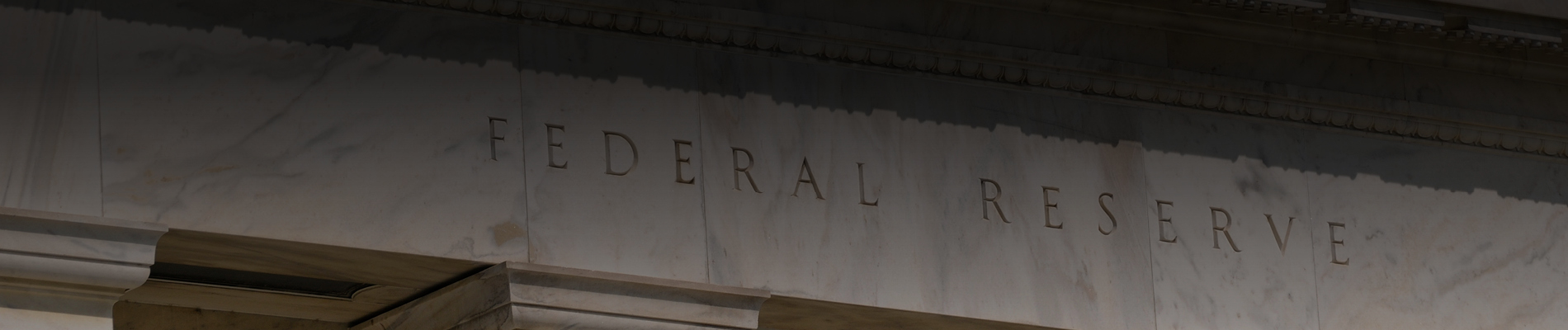

The Fed kept its quantitative tightening (QT) operations unchanged for now. From 2022, the Fed has allowed up to $60bn of Treasuries and $35bn or mortgage-backed securities to “roll off” its balance sheet each month. Since then, the Fed’s balance sheet has shrunk by ~$1.3trn (Figure 1).

Figure 1: The Fed’s balance sheet is shrinking; the Fed may moderate the pace

Source: St Louis Fed, Insight, January 2024

These efforts have reduced excess market liquidity, partly indicated by declining use of the Fed’s reverse repurchase facility (RRP), which has also dropped (from over $2trn to $580bn) since 2022.

We now know Fed members broached the subject of slower QT during the December meeting, to ensure “ample reserves” in the system. Chair Powell stated the central bank will ramp up its discussions on the pace of QT from March. We believe investors may need to wait for an announcement by the summer.

Separately, the treasury announced a potential benign debt supply schedule

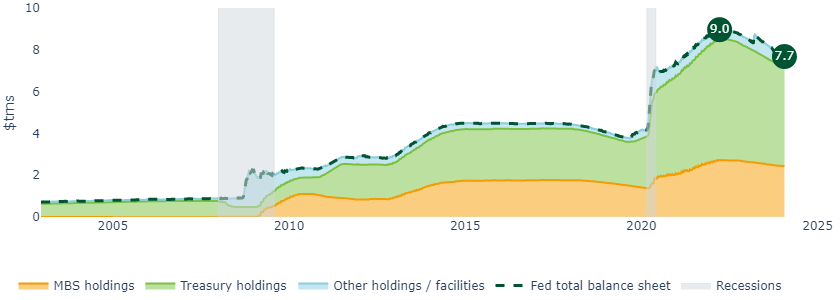

In the morning ahead of the Fed meeting, markets also took note of the Treasury’s quarterly refunding announcement (QRA).

Since the summer, investors had grown concerned that a glut of long-dated Treasury supply would put pressure on yields. The Treasury has been heavily reliant on T-bills rather than bonds for financing since last year’s debt ceiling standoff, pushing bills over the 15%-20% threshold of outstanding marketable securities recommended by the Treasury Borrowing Advisory Committee.

However, the Treasury announced a lower supply of T-bills from Q2 (Figure 2).

Figure 2: The Treasury is normalizing its ratio of T-bills to Treasury bonds

Source: Macrobond, SIFMA, Insight, January 2024

Although we suspect longer-dated bond supply will follow from Q3, we also expect rate cuts will be on the agenda by then, and so market appetite will potentially shift from short-dated cash investments to longer-dated bonds, helping markets absorb the supply.

Therefore, we believe Treasury borrowing patterns are unlikely to disrupt bond markets this year.

Market pricing is out of step with the Fed

In our view, markets are still overoptimistic about the speed of rate cuts over the next few years. Over the next few months, we expect to see volatility as market expectations converge with the Fed’s more conservative projections.

Tactically, that means active investors may find abundant opportunities to exploit rates volatility this year.

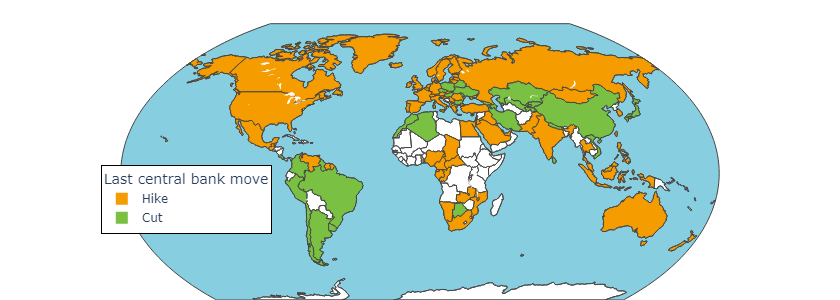

Although the first rate cut might be a little further away than markets are pricing, some emerging economies in Latin America, Eastern Europe, Asia and Africa have already kicked off the global rate cutting cycle (Figure 3).

Figure 3: The US may not be cutting yet, but the global cutting cycle has begun

Source: Macrobond, Insight, January 2024

Strategically, we think this could be a particularly compelling time lock-in yields in fixed income at the top of the rate cycle. However, the opportunity is not limited to the US. We believe fixed income investors that can take a diligent active, global approach may be best-placed over the next few years.

United States

United States