It may be an opportunity to collectively revisit enterprise risk management programs and investment strategy.

Contents

- Summary

- A perfect storm for insurance companies

- Lessons learned and future-proofing for the next perfect storm

- Investment policy should not be independent of underwriting policy

- About Insight

SummaryProperty & Casualty insurance companies have suffered a hardening reinsurance market, historic losses and high inflation, creating the perfect opportunity for insurers to revisit their risk management approach. We believe:

Insight’s insurance team has a history of helping clients model investment risks and downside risks to their surpluses to supplement their strategic planning process and believe such analysis could be key for many insurance company investors looking ahead. |

A perfect storm for insurance companies

Inflation breached 9% in 2022, forcing the Federal Reserve to aggressively tighten policy rates from the zero-bound to above 5%.

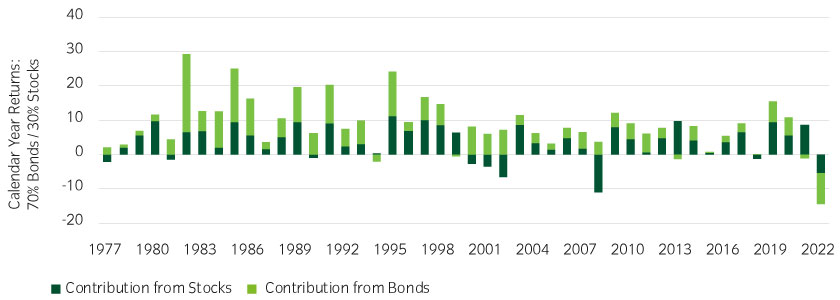

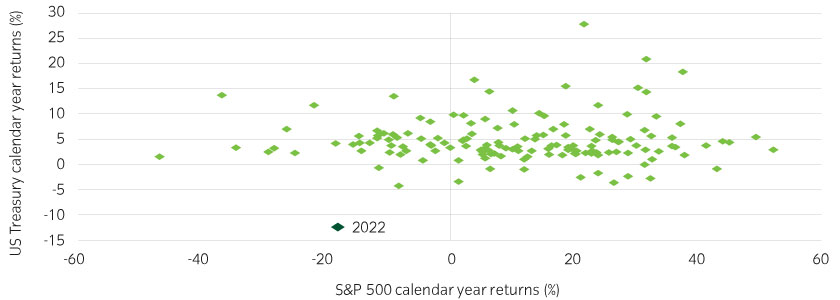

Rising rates made 2022 the worst year for bond returns since the creation of the broad market index in 19761, the first instance of consecutive annual losses, and the first time that bonds and stocks both lost value in almost 50 years (Figures 1 and 2). Further, inflation tends to erode premiums, and increase claims severity trends.

Figure 1: A hypothetical P&C insurer with a 70% fixed income and 30% equity allocation saw no diversification benefit in 2022

Source: Bloomberg, December 2022

Figure 2: Calendar year 2022 was truly an outlier for investment returns

Source: Bloomberg, December 2022 *Data back to 1876. Past performance is not indicative of future results. Investment in any strategy involves a risk of loss which may partly be due to exchange rate fluctuations.

Reinsurance costs rise due to weather-related events, and reduced capital for writing new business

Fitch estimated that 2022 was the third costliest year ever for weather-related events for insurers and reinsurers. Further, poor 2022 investment results reduced the amount of capital available for insurance companies to write new business, further pushing up reinsurance costs. For 2023, Fitch estimates property reinsurance premiums will increase 20% to 60%2. Insurers appeared to keep 90% of their direct premiums, retaining more risk on an absolute basis to manage reinsurance costs (Table 1).

Table 1: Insurance companies needed to write more premiums, retaining more risk as reinsurance costs rose

| Premium Analysis | P&C Industry Collected Premiums ($thousand) | ||||

| 2018 | 2019 | 2020 | 2021 | 2022 | |

| Direct premiums written | 678,266,386 | 712,471,198 | 729,019,771 | 797,828,423 | 875,988,888 |

| Ceded premiums | 59,997,247 | 72,948,876 | 73,538,937 | 81,704,095 | 99,284,018 |

| Net premiums written | 618,269,139 | 639,522,322 | 655,480,834 | 716,124,328 | 776,704,870 |

Source: S&P Capital IQ - P&C Industry, P&C Income Statement as of September 2022

This trend has been particularly difficult for smaller insurers, as they are less able to negotiate reinsurance premiums and are less able to tolerate lower levels of reinsurance protection. The P&C industry has used, on average,10% of direct premiums to buy reinsurance coverage over the last four years3, implying smaller insurers have generally exceeded that level.

Lessons learned and future-proofing for the next perfect storm

Will your enterprise be ready for the next one-in-150-year event?

Calendar-year 2022 data offers the opportunity to test the effectiveness of your enterprise risk management (ERM) program and your company’s risk-tolerance limits.

Persistent volatility and the cycle of uncertainty across multiple factors from rates, inflation, geopolitics as well as environmental challenges are pressuring the insurance industry, necessitating a re-evaluation of core ERM processes.

We believe an overhaul of ERM processes can help insurance companies prepare for the future. In our view, the current underwriting and markets cycle presents many compelling opportunities for insurers to:

- Work collaboratively with investment managers to align underwriting pricing assumptions with capital market assumptions to establish strategic investment guidelines to reduce volatility in net income and ultimately to lower volatility in statutory surplus.

- Retroactively test the effectiveness of ERM policies and revisit risk tolerance limits for all major risks and reinforce the need to implement a holistic approach to modeling surplus risk.

- Consider how recent banking-sector stress exposes liquidity risk and the need for diversification as well as awareness of where liquidity is held.

Investment policy should not be independent of underwriting policy

Insight’s dedicated team of insurance specialists has a long history of working with insurers to model underwriting results and investment results by strategically aligning projected total return assumptions with underwriting pricing assumptions and establishing target volatility limits for investment income and underwriting income.

Adjusting and aligning capital market assumptions are important for two reasons:

- P&C industry ERM practices favor a holistic approach to manage volatility in net income results.

- Projected investment income assumptions used for rates planning are more accurate.

Investment income is the primary driver of the P&C insurance industry profitability (Table 2).

Table 2: Investment Income has dominated P&C historical Net Income Results

| P&C insurer's income ($thousand) statement summary | |||||

| 2018 | 2019 | 2020 | 2021 | Sep-2022 (YTD) | |

| Net underwriting gain/loss |

2,614,640 |

7,807,426 |

11,917,349 |

(521,488) |

(19,918,654) |

| Investment income | 67,728,698 | 67,334,159 | 63,764,308 | 73,914,328 | 56,818,589 |

| Other income | (6,090,826) | (6,354,629) | (5,225,323) | (3,477,025) | (4,206,684) |

| Net income after FIT | 60,752,127 | 63,051,828 | 60,729,489 | 63,237,293 | 33,045,593 |

Source: S&P Capital IQ - P&C Industry, P&C Income Statement as of 9/30/2022

The dominance of investment income on P&C insurers’ income statements presents a great opportunity for insurers to leverage the modelling capabilities of Insight Investment’s insurance solutions team to better understand downside risk to surplus as it pertains to underwriting risk, reserve risk, liquidity risk and investment risk.

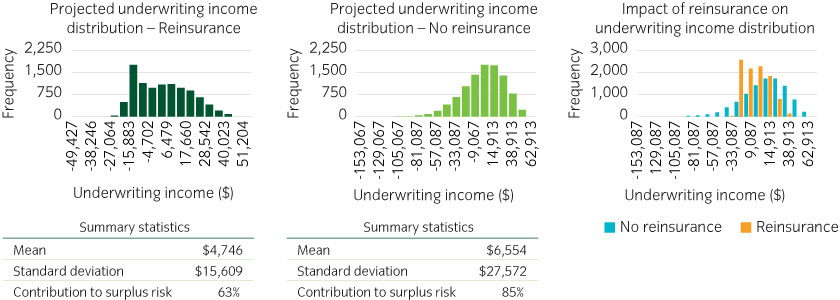

Insight’s team assists clients with dynamic financial analysis, which includes stress testing, strategic asset allocation, and forecasting downside risk to statutory surplus or net position. Figure 3 is a visual representation of the impact of reinsurance coverage on income distribution.

Figure 3: Impact of lower reinsurance coverage on downside risk to surplus

Source: S&P Capital IQ – client Dynamic Risk Modeling Analysis as of 12/30/2020

The extreme range in outcomes provides further support for implementing a more holistic approach to insurance underwriting risk and investment policy objectives, thereby raising the probability that certainty of outcome is achievable.

About Insight

Insight is a global asset manager, responsible for $800bn4 in assets under management across fixed income, risk management strategies and absolute return capabilities. At the heart of our investment philosophy, is a desire to offer clients innovative yet practical solutions. At Insight we manage $32bn for over 50 insurers globally, providing investment solutions that utilize a range of multi-asset capabilities, tailored to the needs of the insurance company.

Our specialist insurance team has a breadth of experience which is used to construct capital efficient investment solutions and provide ongoing reporting, analysis and technical support. We aim to be an extension of your in-house team, working in close partnership with clients and their advisors.

United States

United States