In the US, the FED held the FED funds rate at 5.25% to 5.5%, the first time it has held rates steady for two consecutive meetings since the start of the hiking cycle in 2022. It was, nonetheless, widely expected by the market.

|

The central bank made slightly hawkish changes to its statement, characterizing the pace of the economy as “strong” rather than “solid” and job gains as having “moderated” rather than “slowed”. However, it did note that tighter financial (and not just credit) conditions will likely weigh on economic activity.

The Fed will continue to watch the consumer for signs of weakness

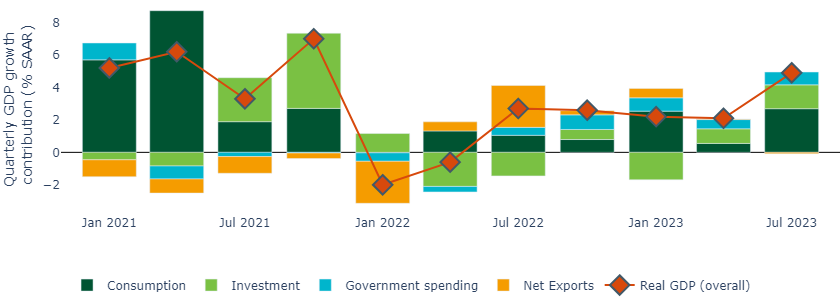

Economic growth remains resilient. Last week’s GDP report showed that the economy expanded at a 4.9% growth rate in Q3, with a particularly strong contribution from consumer spending (Figure 1).

Figure 1: Consumer spending is still strong, despite the Fed’s rate hikes

Source: Bureau of Economic Analysis, St Louis Fed, Insight, November 2023

Powell characterized this economic strength as “surprising”, although he did note that wage growth appears to be slowing, despite continued tightness in the labor market. He stated that he considers risks to the economy to be “balanced”.

Higher long-dated yields are helping the Fed

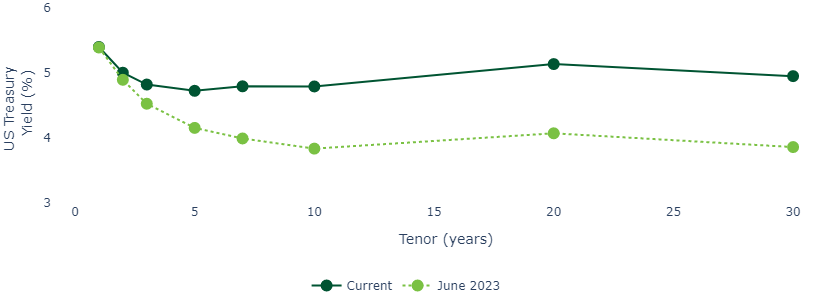

Despite continued economic resilience, financial conditions have tightened as the “lagged” impact of the Fed’s rate hikes continue to be felt. Rising yields at the long-dated part of the curve provide further confirmation of this (Figure 2).

Figure 2: Higher long-dated yield are encouraging for the Fed

Source: Bloomberg, November 2023

Long-dated yields serve as the basis for a large proportion of lending in the real economy and the discount rate for financial market valuations.

Therefore, we believe the Fed is justified in taking a cautious approach to further rate hikes.

The Treasury helped alleviate concerns about a long-dated supply shock

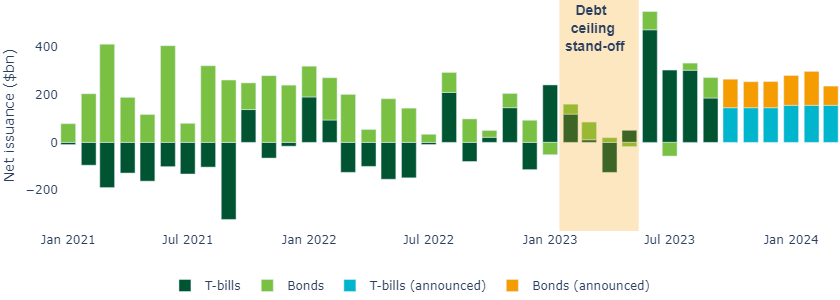

Outside the Fed meeting, investors also closely watched the Treasury’s quarterly refunding announcement which occurred on the same day.

The Treasury is tasked with financing the federal government’s widening deficit, at a time the Fed is stepping away as a buyer. The Treasury also heavily issued T-bills in the aftermath of the summer’s debt ceiling stand-off to replenish funds, stoking fears that this would need to be balanced with heavy bond issuance to ensure a mix of outstanding securities in line with the Treasury Borrowing Advisory Committee’s (TBAC) recommendations.

However, the Treasury announced a relatively modest increase in Treasury bond issuance until the end of Q1 2024 (which includes a slowdown in long-dated issuance) and ongoing T-bill issuance (Figure 3).

Figure 3: The Treasury announced a modest increase in bond supply, reducing risks of pricing dislocations

Source: Macrobond, Sifma, November 2023

The TBAC stated it “supported meaningful deviation from the historical recommendation for 15-20% T-bill share” (the ratio will likely approach 22% at the end of Q1), offering the Treasury flexibility to meet its financing needs.

We had suspected the Treasury would take such an approach, given ample demand from US money market funds (which hold a record of $5.6trn1 in assets) for securities such as T-bills.

We believe that this announcement significantly reduces the risk of a market dislocation in long-dated bond yields from supply shocks.

The hiking cycle may be over

The Fed’s favored inflation measure, core PCE, is currently running at 3.7% year-on-year, in line with the Fed’s year-end forecast. Although inflation will take time to slow toward the 2% target, we believe the Fed will be encouraged by the progress that it has made and the signs that its policy is successfully being transmitted into the real economy.

While the Fed will remain data-dependant, we suspect it has reached the end of its hiking cycle.

United States

United States