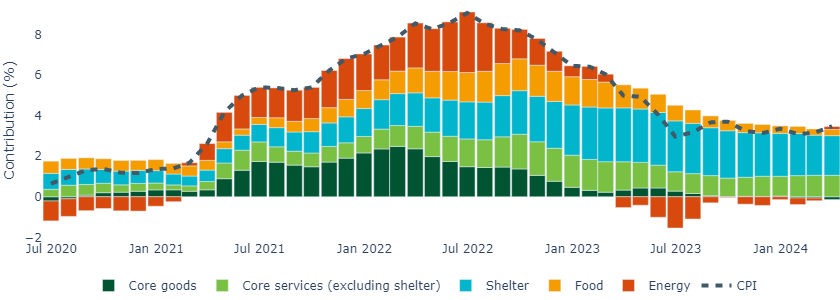

Headline and core prices both rose 0.4% in March, the same pace as in the previous month. On a year-on-year basis, this pushes headline CPI up from 3.2% to 3.5% year-on-year. Core CPI meanwhile remained at 3.8%, pausing its decline.

The print came in above expectations, largely due to an acceleration in energy-related categories and core services. We currently believe this is a temporary setback to a wider disinflationary trend, albeit we suspect the Fed’s rate cutting cycle may now start after the summer.

Energy and core services push inflation above expectations

Energy prices contributed 8bp to the increase in headline inflation in March, and the measure moved back into positive territory year-on-year (Figure 1).

Figure 1: Energy CPI moves back into positive territory year-on-year

Source: Bureau of Labor Statistics, Macrobond, Bloomberg, Insight, April 2024

Core services continue to run strong. Of these, shelter and primary rents increased 0.4% in March (vs. 0.4% and 0.5% prior, respectively). Shelter contributed 15bp to CPI in March. We expect it to continue decelerating, albeit painfully slowly. Excluding shelter, CPI is running at 2.3% year-on-year, up from 1.8%.

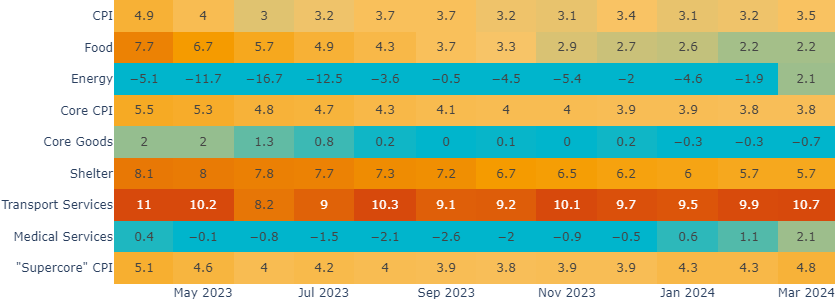

Disappointingly for the Fed, other core services categories remained notably strong. The central banks’ closely-watched “supercore” services measure (which excludes shelter) reached 4.8% year-on-year, up from 4.3%, and the highest since April 2023. It was largely driven by a continued acceleration in transportation services (auto insurance and maintenance services) and medical services prices.

Figure 2: Energy and core services inflation will raise question marks at the Fed

Source: Bureau of Labor Statistics, Macrobond, Bloomberg, Insight, April 2024

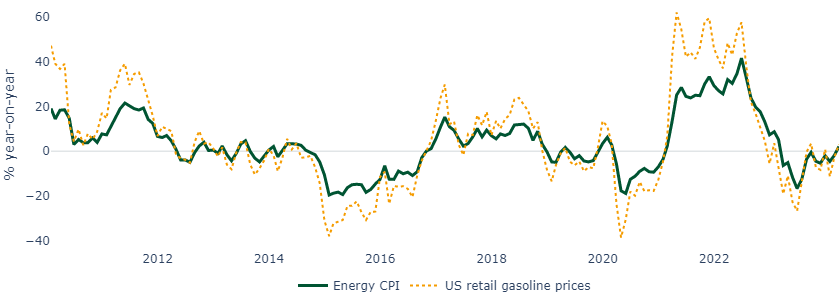

Energy CPI moves back into positive territory year-on-year

Energy prices rose 1.1% in March, following 2.3% in the previous month, taking the 3-month annualized rate to 10.3%. Gasoline prices were up 1.7% in March.

Rising energy prices since the start of the year have largely reflected global supply concerns, given tensions in the Middle East (including continued shipping disruptions in the Red Sea) and export restrictions from producers such as Mexico and the UAE. Global oil prices are close to $90 per barrel for the first time since October last year.

This has pushed energy CPI and US gasoline prices back into positive territory on a year-on-year basis (Figure 3). Given the volatile nature of oil prices, this adds a measure of uncertainty for the Fed, potentially justifying a wait-and-see approach before committing to rate cuts.

Figure 3: Energy CPI and gasoline prices are back into positive territory year-on-year

Source: Bureau of Labor Statistics, Energy Information Administration, Macrobond, Insight, April 2024

A delay in rate cuts may provide opportunities for fixed income investors

The acceleration in supercore services will result in some question marks at the Fed, while energy prices will also be worth watching. However, as long as wage growth continues to moderate, we believe broad disinflationary trends should continue.

In our view, if the Fed delays its rate cutting cycle, there are potential upsides for investors, as it will allow them more time to consider allocating into fixed income at the top of the rate cycle against the backdrop of a strong economy.

United States

United States