The Fed took a modestly more hawkish tone at the latest FOMC meeting, but announced it will begin slowing its pace of quantitative tightening. We still project rate cuts this year and believe it remains a compelling time to add fixed income exposure.

The Fed continues to take a modestly “hawkish” turn

The FOMC left the Fed Funds rate unchanged but amended its official statement to add that “In recent months, there has been a lack of further progress toward the Committee’s 2 percent inflation objective”. This reflects disappointing inflation prints so far this year.

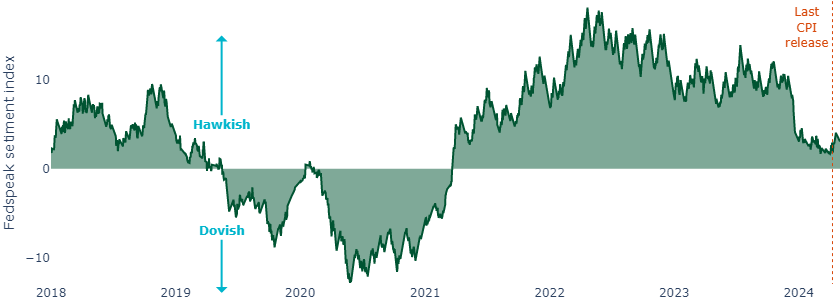

Chair Powell stated “gaining greater confidence” that inflation will sustainably return to target may take “longer than previously expected” and the central bank is prepared to keep rates unchanged “as long as appropriate”. This is consistent with Powell and the committee’s shift to modestly more hawkish rhetoric, since the last CPI report, given unexpectedly slower disinflation than expected so far this year (Figure 1).

Figure 1: Fedspeak has become modestly more hawkish since the last CPI report

Source: Bloomberg, natural language processing model trained on news headlines, May 2024.

Elsewhere, Chair Powell announced the Fed will slow quantitative tightening from June (to ensure “ample reserves” in the system). It will allow a monthly cap of $25bn of Treasuries to roll off its balance sheet, down from $60bn. However, it will leave the $35bn cap on maturing mortgage‑backed securities unchanged.

Markets may have flipped from too optimistic to too pessimistic

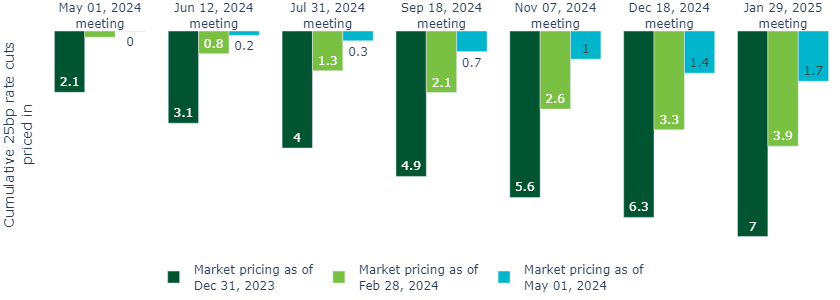

At the start of the year, markets were pricing as many as six cuts in 2024 and are now only pricing only one (Figure 2). In our view, markets have switched from far-too-optimistic to modestly pessimistic. We see two cuts by the end of the year as a reasonable base case.

As such, we see market pricing as providing a particularly compelling opportunity to invest in fixed income ahead of the rate cycle.

Figure 2: Market pricing has swung from projecting six cuts in 2014 to just one

Source: Bloomberg, May 2024.

Rate cuts elsewhere may benefit investors with global fixed income exposure

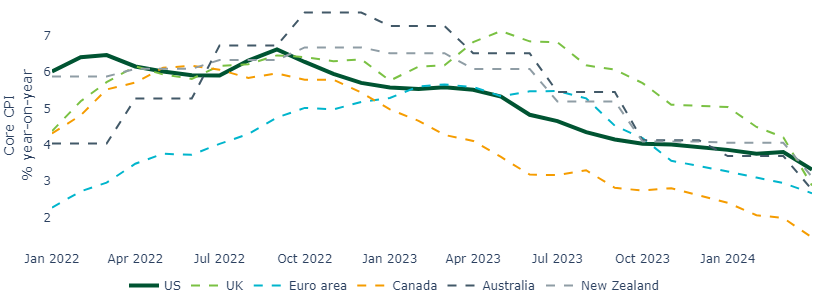

At the start of the year, it appeared the Fed would be the first or one of the first developed market central banks to cut rates this cycle. However, disinflation in the US so far this year has been notably slower than most other markets, with US core CPI going from cooler than most of its peers to hotter as a result (Figure 3).

Figure 3: Slower disinflation in the US may mean the Fed will cuts rates after its peers

Source: Macrobond, National sources, May 2024.

The Fed may now be one of the last to cut among developed market central banks.

So, while those with mostly domestic fixed income exposure may need to wait a little longer for rate cuts to take effect, those with global fixed income exposure may benefit from rate cuts in advanced economies sooner.

United States

United States