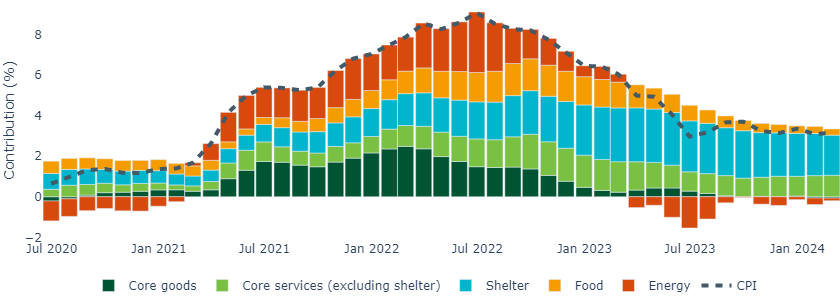

Rising energy prices in February helped inflation accelerate slightly, but the main consideration for the Fed in our view remains “core services” components, particularly shelter. The good news is we believe shelter will continue to ease (albeit slowly), over the coming months.

Energy rebounds but “core services” continue to dominate

The main driver of inflation overall continues to be the “core services” categories (which includes shelter and “supercore” services), which account for 97% of the rise in CPI on a year-on-year basis.

Energy prices rose 2.3% month-on-month, contributing 0.15% to the monthly rise in CPI, with gasoline prices the main driver.

Figure 1: “Core services” sectors are dominating year-on-year inflation

Source: Bureau of Labor Statistics, Macrobond, Bloomberg, March 2024

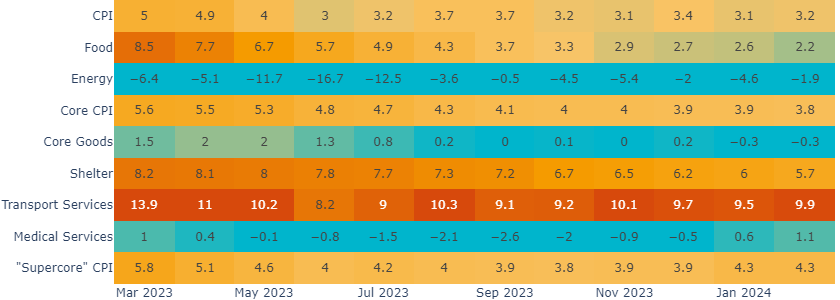

“Supercore” services remained relatively high, supported in particular by an acceleration in transportation services, which remains the last “red hot” category in Figure 2.

Encouragingly, the “shelter” component moderated on a year-over-year basis, reaching the lowest level since July 2022.

Figure 2: Shelter moderates while transportation services accelerates

Source: Bureau of Labor Statistics, Macrobond, Bloomberg, March 2024

We still expect shelter inflation to continue easing

Last month, the “owner’s equivalent rent” component of shelter inflation was particularly strong, prompting The Bureau of Labor Statistics to provide additional context. It indicated the print was the result of a change in methodology, given a reweighting toward single-family homes within the underlying surveys, essentially reflecting a statistical artifact rather than a new trend. This analysis is supported by today’s print, with owners’ equivalent rent moderating to 0.4% month-on-month from 0.6% last month.

Shelter nonetheless remains a concern for the Fed because it tends to be the “stickiest” component of the CPI. Rental prices move slowly, partly because they typically get locked in for a year. Further, shelter CPI is based on surveys the Bureau of Labor Statistics only refreshes every six months. Finally shelter CPI tracks all tenants, rather than just new tenants, and so tends to be less volatile than private rental indices maintained by agents like Zillow or Apartment List.

The good news is shelter CPI is relatively predictable over the medium term. Studies and historical pricing show that, due to its methodology, shelter CPI tends to directionally lag private rental indices by up to a year. At present, it appears shelter CPI should continue moderating in the coming months (Figure 3).

Figure 3: Leading indicators indicate shelter inflation will continue falling

Source: Bureau of Labor Statistics, Zillow, Apartment List, March 2024

The Fed’s preferred inflation measure is less dominated by shelter

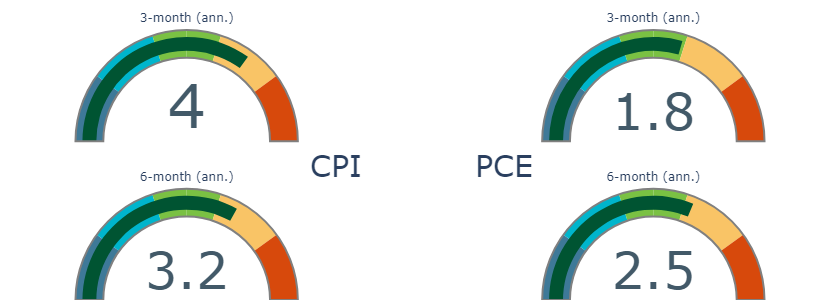

The Fed’s preferred inflation measure, PCE is running significantly closer to the Fed’s 2% target than CPI, particularly on a 3-month and 6-month annualized basis (Figure 4).

Figure 4: PCE inflation is trending closer to 2% than CPI

Source: Bureau of Labor Statistics, Bureau of Economic Analysis, Insight calculations, March 2024

The major culprit behind this divergence is shelter, which makes up more than a 30% weight in the CPI, but only ~15% in PCE. As such, even if shelter holds back the CPI index, we expect faster progress on PCE, which is particularly important for the Fed. Indeed, when stripping shelter out of the CPI, the index is running at 1.8% year-on-year, below the 2% target.

Ultimately, we believe inflation is still moving in the right direction, and we expect to see it edge closer to the Fed’s target, keeping rate cuts firmly in the conversation for later in the year, which we continue to believe makes for an attractive environment for fixed income investors.

United States

United States