Key takeaways from reciprocal tariffs

- “Liberation day” tariffs will stifle global trade.

- While some of these tariffs might be negotiable, the process appears challenging, with a permanent minimum tariff level aimed at rebalancing trade, raising revenue, or to stymie China.

- Although estimates vary regarding the impact on growth, forecasters overwhelmingly predict a negative impact worldwide, increasing the risk of a global recession.

- Inflation impact estimates also vary, with a certainty of higher inflation in the US, while other regions' outcomes depend on their policy choices regarding retaliation and secondary tariffs.

- This situation likely does not represent the peak of tariffs or uncertainty. The investment implications are unfavorable for most risk assets including equities and credit. However, it could be beneficial for rates (especially real rates), and gold is expected to remain expensive. The foreign exchange landscape is complex, as the natural inclination towards a stronger US dollar due to risk aversion and trade balancing might be countered by a structural shift in reserves.

A significant headwind for global trade

President Trump announced a range of measures on 2 April, executed via executive order1:

- A base tariff of 10% on most imported goods will be effective from 5 April. This fulfils a campaign promise and is almost certainly permanent, aiming to rebalance trade, reshore production, and raise revenue. This tariff level includes uninhabited territories near Antarctica.

- ‘Reciprocal’ tariffs on 57 countries will be effective from 9 April. These tariffs are not reciprocal in the sense of matching other countries' tariffs or trade barriers. Instead, they are calibrated to be half the US bilateral trade deficit divided by US imports from that country. The EU will face a 20% tariff, China an additional 34% (bringing total tariffs on China to 54%, close to a campaign promise of 60%), Japan 24%, Vietnam 46%, and so on (see Table 1). These tariffs may be subject to negotiation, but fundamentally they aim to rebalance trade deficits. The only way to negotiate a reduction will be to agree on something that reduces the US bilateral trade deficit with your country to 20% or less of US imports from your country. Implicitly, these reciprocal tariffs could be doubled if trade partners retaliate.

- The loophole that allowed packages from China worth less than $800 to be imported tax-free will be closed. This change is permanent and long overdue, with bipartisan support.

- Auto tariffs of 25% will be effective immediately, as previously announced. These tariffs are probably permanent as they aim to reshore auto production, but exemptions may be up for negotiation.

- Exceptions will be made for Canada and Mexico (already subject to 25% tariffs on non-USMCA compliant goods) and certain sectors that either already have separate tariffs (steel and aluminum, and now also autos), are likely to be tariffed in the near future (copper, pharmaceuticals, semiconductors), or are strategically important (critical minerals, energy).

- It was notable that Russia was not included in the list, but most Russian goods are subject to sanctions.

Table 1: Change in trading partner-level tariff rate by tariff package (pp)2

In terms of stymying China, not only does China face high tariffs, but third-party countries in Southeast Asia such as Vietnam and Cambodia, which Chinese companies used to re-route shipments from 2018, are also affected. Additionally, poor African countries that previously exported clothing and textiles to the US free of tariffs under the African Growth and Opportunity Act (AGOA) program, often from Chinese companies’ setup in those countries, are now facing significant tariffs (e.g., Lesotho at 50%, Madagascar at 47%).

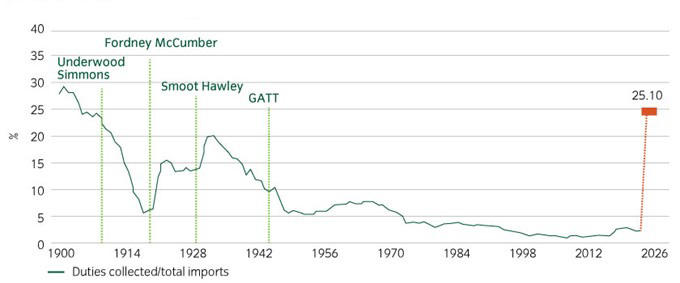

There are various estimates for the total effective tariff rates, ranging from Goldman Sachs at 18.8% (as outlined in Table 1) to UBS at 25.1%, primarily depending on assumptions made around Mexican and Canadian trade. Regardless, the effective average US tariff is soon to be significantly higher than anything seen since the early 20th century (see Figure 1). This is much more substantial than the 2018 tariffs and represents a regime shift in global trade.

Figure 1: US effective tariff rate 1900 to 20253

What to look for next

Sectoral tariffs for items such as copper, lumber, pharmaceuticals, and semiconductors are still forthcoming. Due to their importance and the lack of immediate US spare capacity, these sectors are either still under section 232 investigation (which aims to consider the impact of imports on national security) or are likely to be so. Naturally, this will contribute to lower growth and higher inflation pressures, but in a more limited way than the 2 April announcement.

The key aspect to monitor going forward is how other countries respond to these measures. Some economies will retaliate with tariffs on US goods and other measures such as export restrictions, and restrictions on trade in services or access to FDI or public procurement. China has already introduced counter tariffs on US imports. Canada and the EU are also likely to pursue this approach initially, even if the ultimate aim is future negotiations to remove trade barriers and tariffs. Retaliation will likely lead to weaker US growth, higher inflation in the retaliating country, and the risk of further escalation from the US.

Other countries may take a less confrontational approach and try fiscal support for their export sectors. This approach depends on having fiscal space and may also aggravate the US, but it will likely lead to a reduced growth impact domestically. China will almost certainly try this, and others are considering it. Finally, some countries may do nothing and hope to negotiate a Free Trade Agreement in the future, if US trade negotiators ever get the time.

Most read

Global macro

April 2022

Global Macro Research: Modeling the persistence of US inflation

Global macro, Fixed income

May 2023

Global Macro Research: Debt ceiling stand off

Liability-driven investment, Fixed income, Responsible investment

December 2023

Thoughts for 2024

Fixed income

June 2024

United States

United States