Headline consumer prices rose 0.3% in January, from 0.2%. This takes CPI from 3.4% to 3.1% year-on-year, slightly above the 2.9% expected. Core prices rose 0.4% last month, up from 0.3% in the prior two months and remained at 3.9% year-on-year.

The sticky shelter component continues to be the main culprit behind this increase in inflation, and highlights how the path to 2% will continue to be bumpy.

Shelter and supercore CPI drive higher-than-expected inflation

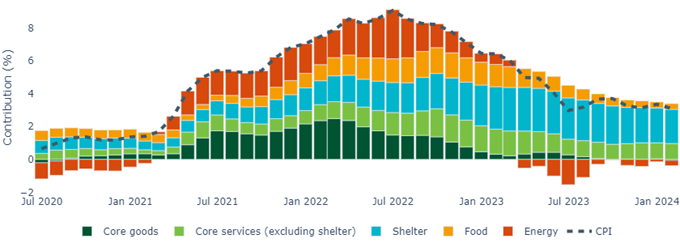

While food prices rose 0.4% year-on-year in January it has been trending lower. Lower energy prices also helped ease some inflation pressures (Figure 1).

Figure 1: Food, energy and core goods inflation continues to be modest

Source: Bureau of Labor Statistics, Macrobond, Insight, February 2024

However, the “sticky” components of the index continued to prove stubborn.

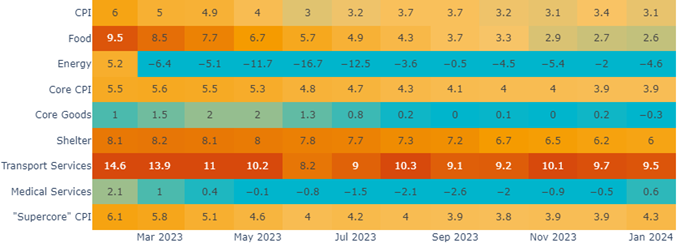

Of these, shelter continued to demonstrate steady disinflation year-on-year, but in January saw notable contributions from both rent and lodging away from home (such as hotel costs). Nonetheless, we expect shelter will continue gradually decelerating over the next few months.

Elsewhere, the “supercore” component (core services excluding shelter) reached its fastest year-on-year rate since May 2023, driven in large part by transportation and medical services, up 1.0% and 0.7%, respectively, in January.

Figure 2: Inflation in the sticky core services components is still gradually easing

Source: Bureau of Labor Statistics, Macrobond, Insight, February 2024

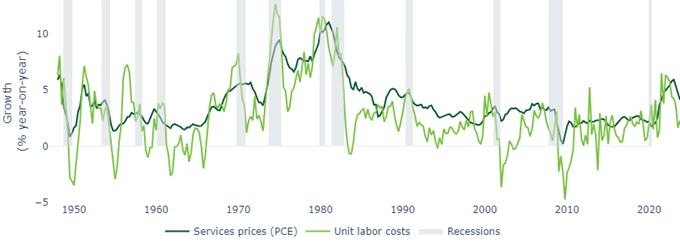

We still expect services inflation will ease

Given a wider trend of easing labor costs, we believe it should translate into lower services inflation in the months ahead (Figure 3).

Figure 3: Labor market costs are easing, which could be a good sign for services inflation

Source: Bureau of Labor Statistics, Macrobond, Insight, February 2024

Although shelter and core services categories were disappointing this month, looking at the big picture we still believe the wider disinflation story is fully in play.

We expect headline and core CPI are on course to reach or close in on the Fed’s 2% target by the summer, which is around when we anticipate the first rate cut. In our view, this release endorses our believe that there will be fewer rate cuts this year than markets expect.

The path to 2% will be bumpy, however, and there may be bouts of volatility along the way as a result, which may provide particularly compelling entry points in fixed income for those looking to lock in yields while we are at the top of the rate cycle.

United States

United States