An interview with Cathy Braganza, senior portfolio manager at Insight investment

What is the outlook for high yield debt?

We’re expecting some small spread tightening as there’s so much cash coming into the market due to credit quality improving. Higher yields, low defaults and improved credit quality are the three factors which are attracting investors.

However, because credit quality in both US and European high yield now is remarkably different to what it was 10 years ago, a historical comparison of spreads becomes less relevant.

How has credit quality in high yield improved in recent years?

We are seeing the lowest proportion of CCC debt within the high yield universe for over a decade, with European high yield securities now primarily consisting of BB-rated debt and US high yield debt now rated B+ on average. This is the highest overall level of credit quality in high yield for over a decade.

Part of the reason is that management teams within the high-yield debt sector have generally done a good job in reducing leverage and debt levels post pandemic. Interest coverage and EBITDA1 margins are now strong across the market.

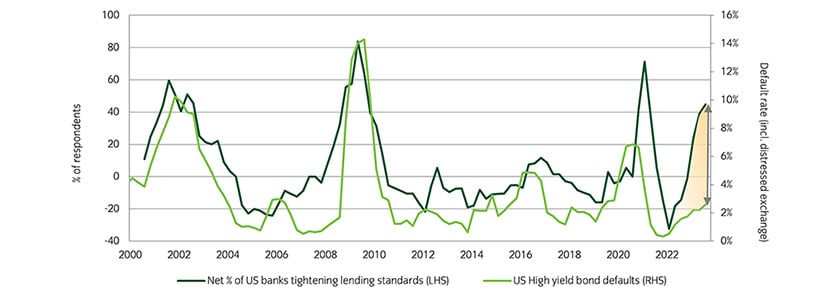

Why have defaults for high yields fallen over 2023 and 2024?

An influx of support from the private debt market has enabled troubled high yield issuers to access new capital. Increasingly, we have seen distressed companies going to the private debt market to refinance rather than use public markets. This means weaker companies are being weeded out of the market, improving credit quality and reducing the level of defaults. Looking ahead, I expect annual default rates to stay within a range of 2-3% for Europe and the US.

Figure 1: Where have the defaults gone?

Source: Federal Reserve Senior Loan offices survey and JP Morgan as at 31 December 2023.

What are the biggest risks to credit now?

The main risk is macroeconomic data, such as a spike in inflation or a rise in the price of oil. It’s more about risk outside the market, rather than individual credit risk.

A company that needs to refinance in 2024 is doing so at a much higher rate than before. How much of a concern is this?

We are less concerned for companies that are refinancing because they have a business plan to meet; depending on how the business plan eventuates, they’ll likely recall these bonds in two years’ time and refinance at a cheaper rate.

What areas of high yield give you concern?

In the US, we see the technology, media and telecommunications sector as a bit of a worry. We see companies that are stressed due to concern on subscriber numbers, and their capital expenditure levels. In Europe, we see no sectors under stress.

How do you seek to maintain credit quality in your portfolio?

We meet the companies we invest in and talk through the issues they face. Investors will have some clear expectation of what they would like to see in terms of cash generation, and it is important to assess corporate issuers' budgeting and cashflow. It is also important to identify the risks that could lead to a sharp deterioration in an issuer’s credit quality.

Why invest in short-dated high yield?

We believe exposure to short-dated high yield can offer investors some protection against gyrations in the US Treasury curve. We don’t need interest rates to move to make money. Plus, the beauty of short-dated high yield is that investors are being compensated for staying put in terms of duration.

United Kingdom

United Kingdom