|

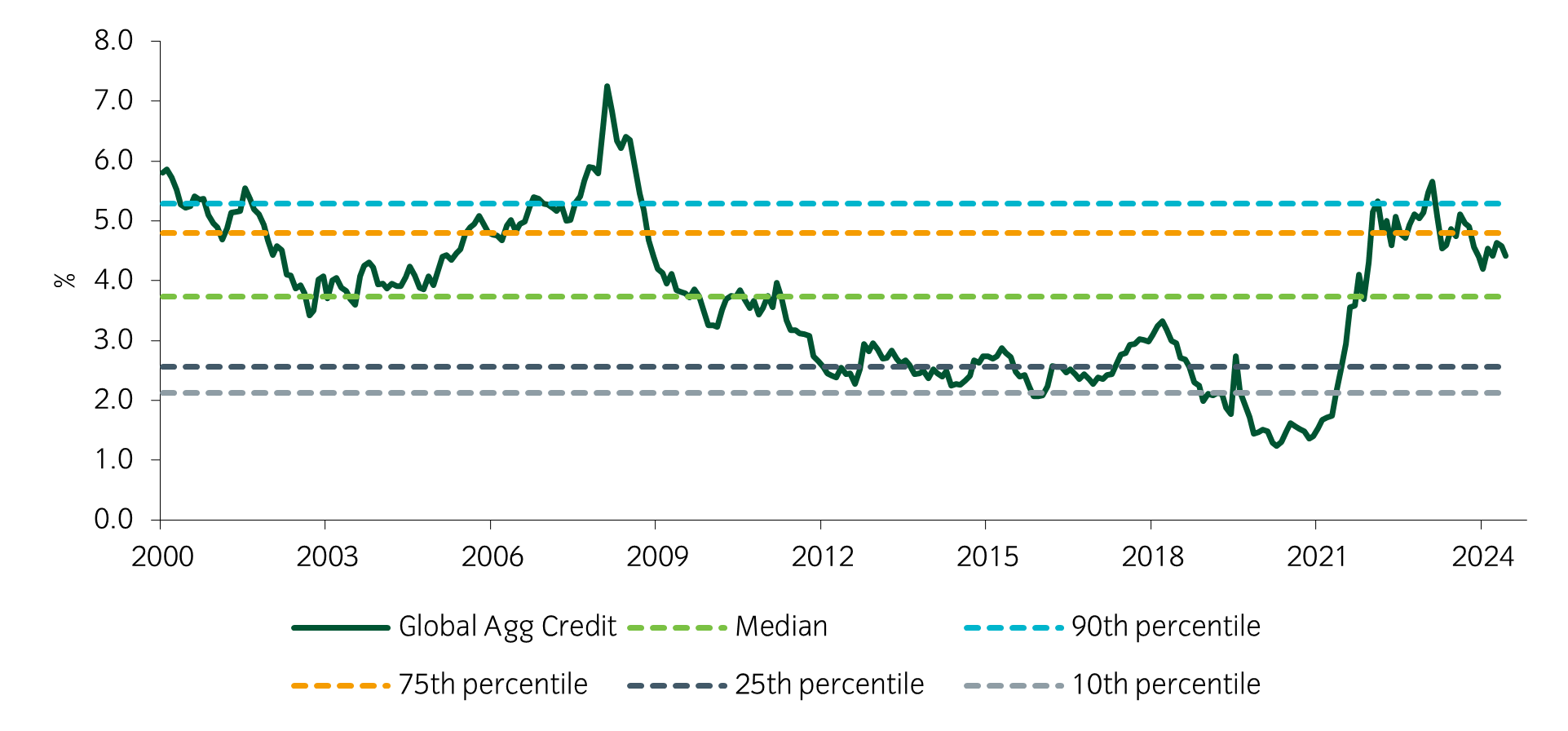

The absolute level of yields remains close to historically attractive levels |

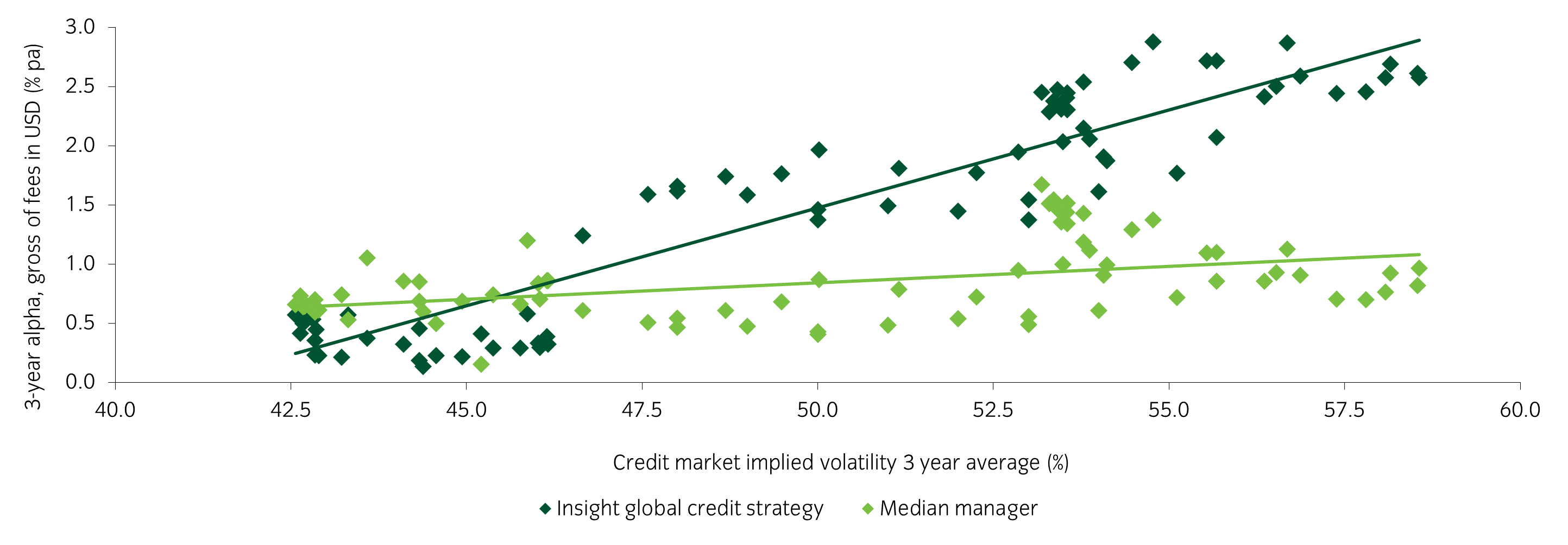

Volatility provides a healthy environment for active managers to add value |

Solid corporate fundamentals have helped spreads decline close to fair value, but relative value opportunities remain |

Higher absolute yields provide an income buffer against capital losses should yields rise again |

Yield trumps spreads – In our view, the level of yield available in global investment grade credit continues to represent an attractive draw to investors, outweighing the relatively low level of spreads. Higher income from higher yields provides a deeper buffer against potential capital losses in the event that yield levels rise.

Figure 1: Yields on global investment grade credit have risen to offer better value than for more than a decade

Source: Insight and Bloomberg as at 28 February 2025. Bloomberg Global Aggregate Credit Index.

Don’t be afraid of volatility – Historically, periods of high market volatility have been those where active managers like Insight have been able to thrive, while adopting a global approach allows managers to look across a rich and broad universe in the search for outperformance.

Figure 2: Alpha increases as implied volatility increases

Source: Insight and Mercer. Insight global credit strategy outperformance in USD terms, of Bloomberg Global Aggregate Credit Index hedged into USD, gross of fees. Mercer Insight Universe median manager alpha versus global credit sector benchmark index.

Adding further flexibility, to invest beyond the benchmark markets, can also enhance the scope for investors to capture the diverse range of value available, as well as provide some degree of protection during periods of crisis.

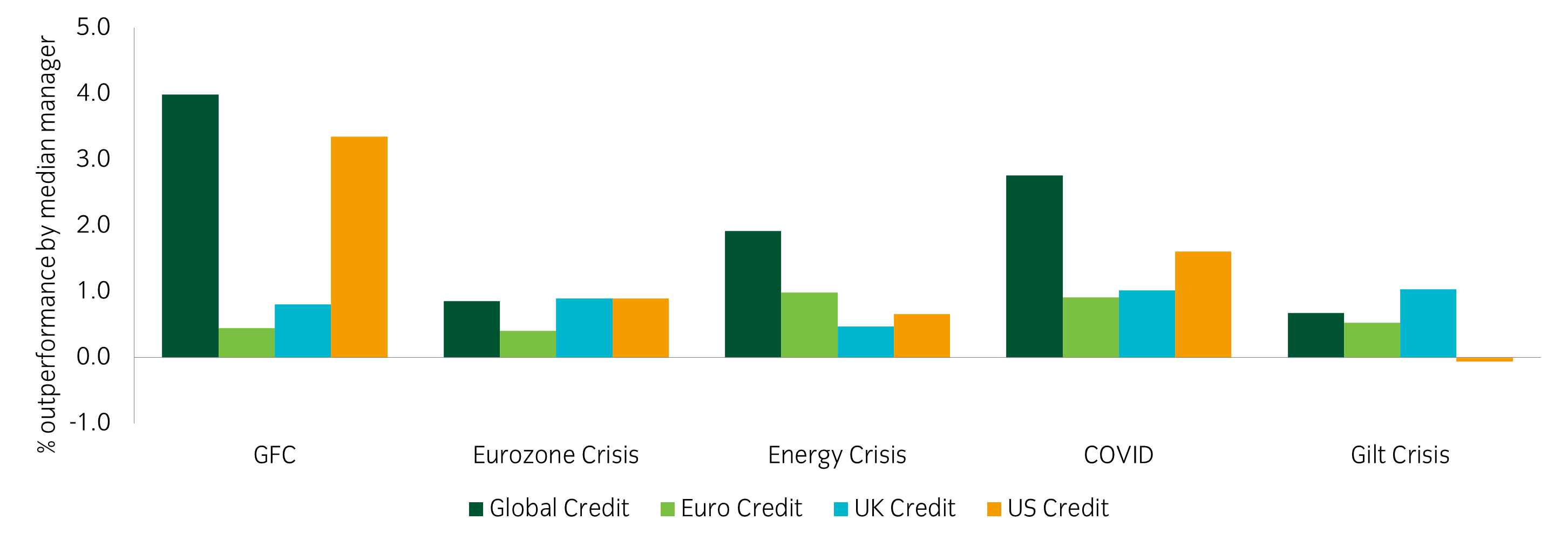

Figure 3: A global approach works when global crises hit