An interview with Manuel Hayes, senior portfolio manager at Insight Investment

Why invest in fallen angel bonds?

Fallen angels are bonds that have fallen out of investment grade indices and into high yield. As an investment manager we try to take advantage of any mispricing after these bonds lose their investment grade status.

The mispricing is caused when investors such as index funds and ETFs are forced to sell these bonds as a result of the rating downgrade. Frequently these sales cause disproportionate spread widening during the month of the downgrade, which often reverts once trading activity normalises.

This pricing opportunity means that despite generally having tighter credit spreads than other high yield bonds, our analysis shows that fallen angels’ total returns have historically seen the highest credit spread performance. Over longer periods we have seen fallen angels deliver high yield returns plus 2.5% to 3%.

Common ways asset allocators use fallen angels in portfolios include:

1. Core/satellite: We see a lot of larger investors who combine a broad, high yield portfolio with a more return-seeking opportunistic fallen angels strategy, using it as a growth engine in case there is a spike in downgrades.

2. Multimanager diversification: Some investors seek diversification across their lineup of high yield managers, and fallen angels offer a differentiated return profile to most traditional high yield managers.

3. A preference for quality: Some clients use fallen angels as their preferred way to access high yield, due in part to the higher-quality nature of the securities.

Spreads on high yields are currently tight compared to historical averages. Does that make fallen angel bonds expensive?

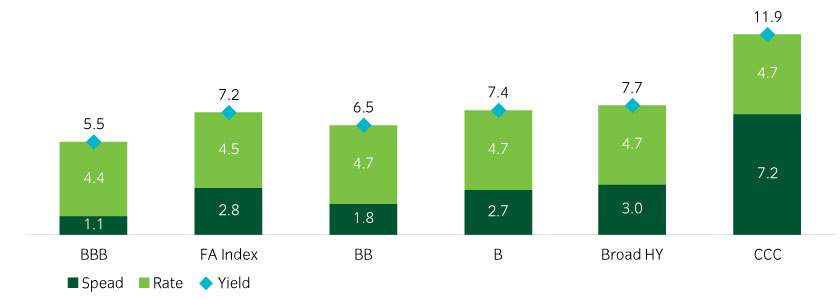

The fallen angels universe commonly offers spreads and yields similar to BBB/BB-rated bonds (see Figure 1). However, as of March 2024, fallen angel bonds are offering higher spreads and outright yields. We believe this differential offers investors higher relative value.

Figure 1: Fallen angels currently offer more attractive yields and spreads than BBB and BB-rated bonds2

Source: Bloomberg US High Yield Fallen Angel 3% Cap Index

What will happen to fallen angel bonds if there is a recession?

We have had the most telegraphed recession we’ve seen for a long time; everyone keeps waiting for it to happen, but the economy keeps surprising on the side of resilience. This has been hurting investors, as they’re again too cautious about just the spread relative to history and not thinking about calculating expected returns from each asset class.

One thing that is under-evaluated is the power of carry. So, you could ask: “What is the cost of sitting and waiting for the worst thing to happen?” In equities, if you get it wrong, it may take longer climb out of, but by contrast bonds revert to par.

How do you overcome the difficulties around illiquidity in high yield bonds?

In our typical experience, liquidity has never been better. We trade through brokers in the ETF sector where ease of trading has continued to evolve over the past five to 10 years. We have found that with the right technology, tools and relationships, we can trade custom baskets of up to 1,000 bonds worth as much as $500m within hours if not minutes; we can sell this way too.

The asset class is only illiquid, in our experience, if you’re trading in traditional ways, by calling brokers and trading one bond at a time which can take days or a week to implement. This can cost 60bp to 80bp for each trade, in our experience, whereas when trading large custom baskets, the fee is typically in the range of 10bp to 20bp for each security.

High yield is a beautifully inefficient asset class due to the untapped exposure that some managers are not buying into. These are smaller companies, smaller issues, illiquid bonds, fallen angels and private companies. It’s beautiful because if you can get exposure to it and manage the risk on the margin, you can potentially enjoy very strong returns.

Can you describe the systematic models that Insight uses?

Our investment process uses systematic and quantitative models. In the fixed income world this tends to represent a narrow segment of structural alpha opportunities, as opposed to equities where there can be a wide ice-cream parlour selection of all sorts of factor flavours. While the academic research can show highly seductive back-test results, we believe it is critical to consider implementation, and ensuring models are representative of the real world.

In terms of a quantitative approach, we find the best results in a bottom-up approach, where we’re looking at each company or bond on a relative basis. We avoid making decisions where we don’t have strong empirical evidence of predictive power. One perspective is that from a top-down basis we can adhere closely to a client’s desired asset class and sector exposure.

What are one of the advantages of a systematic approach?

One of the ways our systematic approach works well is protecting the portfolio from downgrades and defaults in a cost-effective manner. The model scrapes balance-sheet information like leverage, profitability, and earnings metrics daily and so can compare each company on an equal basis, providing us with accurate results for understanding which companies might be at greater risk relative to peers.

This is very cost-effective downside protection, in our view, whereas discretionary managers are likely to pay through the nose either through a defensive low-beta profile or explicit downside protection.

Our time-tested models have tended to produce alpha during sell-offs due to this tilt to higher-quality issuer profiles; however, importantly, when the market reverses, we can fully participate in the upside with a beta 1 exposure. This convexity profile and consistency of performance is a key value proposition to our clients.

United Kingdom

United Kingdom