|

Senior portfolio manager David Hooker answers questions on Insight’s outlook for UK gilts, and provides his thoughts on recent announcements from the DMO. |

Why have long-dated gilt yields been so volatile over the last few months?

Although international factors have played a key role in recent gilt market moves, there have been some underlying domestic factors at play as well.

On Wednesday 26 March, the Debt Management Office (DMO) published its funding remit for fiscal year 2025 to 20261. The most striking statistic within the publication wasn’t the scale of gross gilt issuance, a whopping £299.2bn (though this was slightly below expectations), but rather the reduction in planned long-dated issuance to 13.4% of total issuance, down from 18% in the prior year. This was accompanied by a sharp rise in the unallocated reserve: this is issuance that can be allocated to any sector by the DMO dependent upon market conditions, to 9.2%, up from just 4% in the prior year.

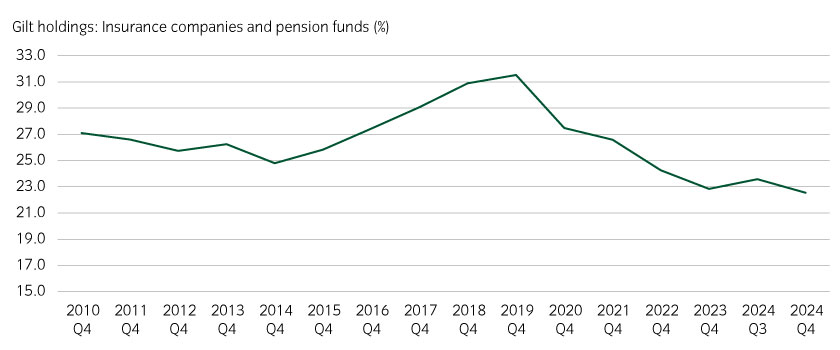

The issuance of index-linked and long-dated gilts has been declining for years. However, the size of the reduction this time was significant and reflects the declining importance of insurance and defined benefit pension funds as buyers of gilts (see Figure 1).

Figure 1: Insurance companies and pension funds are declining in importance for gilt markets

Source: Insight, DMO. Data as at 31 December 2024.

Were there any other interesting points that came out of the funding review?

The DMO also introduced programmatic gilt tenders as a new method of issuance. This is a new initiative that allows the DMO to conduct sales on very short notice to take advantage of market conditions. For example, if the valuation of a specific bond shift away from the market due to a lack of liquidity. These operations will typically involve the sale of ’off-the-run’ gilts and appears to be a strategy designed to improve the liquidity of the gilt market by narrowing the yield spread seen between high-coupon current bonds and older high-coupon bonds that are largely bought by investors seeking to hold them to maturity, and thus not currently available for sale.

How did markets react after the publication was released?

Although the remit promised less long-dated gilt issuance than investors expected, the gilt yield curve continued to steepen aggressively.

In early April, the DMO issued revisions to this remit3, following publication of the Office for National Statistics 2024/25 central government net cash requirements. Typically, the gilt remit revision in April is a routine exercise that addresses any known shortfall in government funding from the previous fiscal year. It usually involves minor adjustments, with allocation proportions remaining unchanged and any changes in issuance distributed on a pro-rata basis.

This time was vastly different.

The final borrowing numbers for the 2024/25 fiscal year showed an increase in borrowing of £4.9bn. Gross gilt issuance fell marginally to £299.1bn, but the UK Treasury Bill contribution, very short dated zero-coupon securities, increased by £5bn. The allocation to long-dated gilts within total issuance was reduced further. The original remit had indicated issuance of £40.2bn, representing 13.4% of total issuance, but this was cut to £29.8bn, an allocation of just 10%.

For the DMO to make such a radical change to the revised remit would suggest a certain amount of displeasure with market developments since the publication of the original remit in March.

The absolute level of gilt yields would appear to be a factor. Yields moved sharply higher in the days after the remit was released, peaking some 30bp higher at 5.6%4.

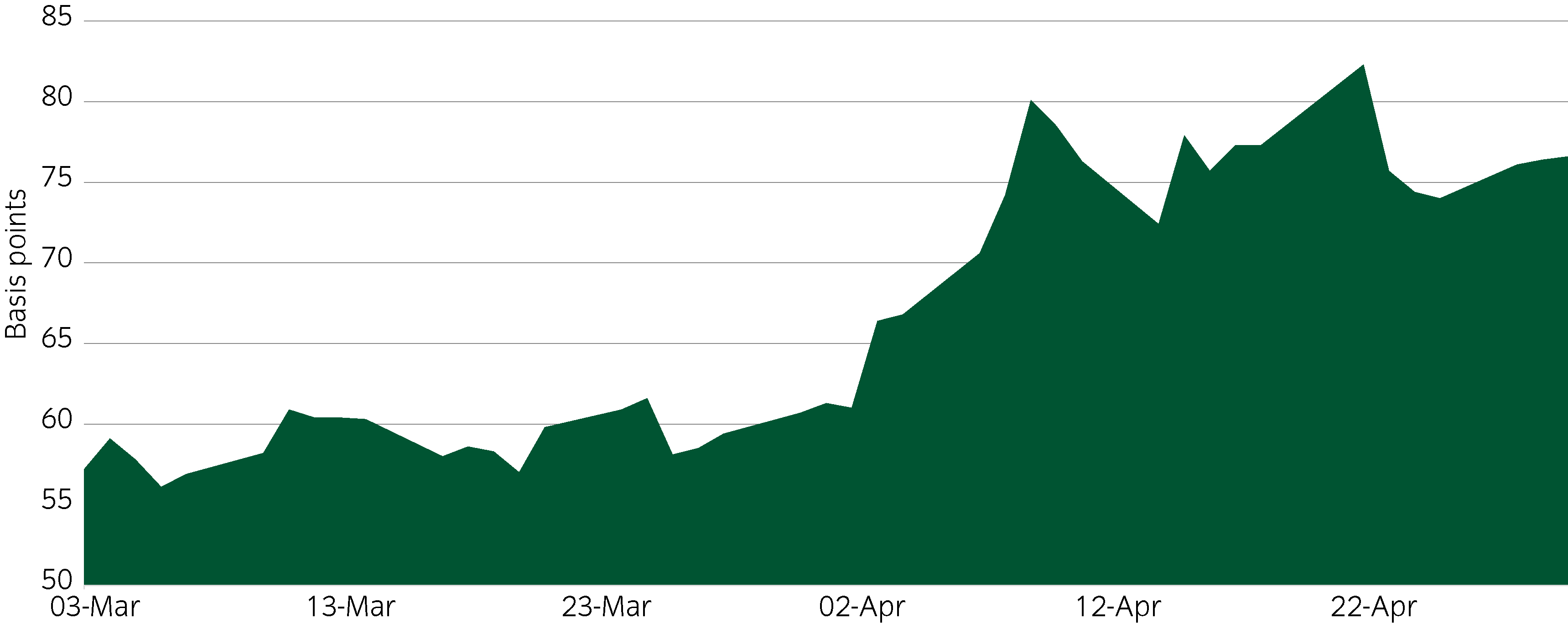

This move partly reflected global factors, but the sharp steepening in the long end of the gilts curve (see Figure 2) suggested that domestic factors were also an influence.

Figure 2: The gilt yield curve steepened considerably at the long end (30-year yields versus 10-year yields)

Source: Insight, Bloomberg. Data as at 30 April 2025.

Does this imply the DMO will be more strategic in its issuance going forward?

A fair conclusion driving the DMO’s decision-making process in the current environment is a ‘value for money’ assessment. With the steeper yield curve over the past month, there has been an increase in the premium required to issue 30-year gilts rather than shorter maturities. The motivation for the change becomes clearer when looking at the DMO’s funding objective. This has arguably been ignored by the DMO for some time but was an important factor in the early years of its existence when assessing the weighted average maturity of gilt funding:

“The DMO's remit is to carry out the Government's debt management policy of minimising financing costs over the long term, taking account of risk, and to minimise the cost of offsetting the Government's net cash flows over time, while operating in a risk appetite approved by Ministers in both cases.”6

Put simply, funding in the long end of the gilt curve, at this level of yields and with this yield curve shape, no longer makes sense when considered from the perspective of the issuer. Similar logic can and should be applied to index-linked issuance where the weighted average maturity of issuance has not fallen in recent years.

Fiscal sustainability is enhanced if there is a positive gap between GDP growth and 30-year real yields. However, if real yields are sustained at current levels, this gap is projected to be negative for the next five years. Given the historically high starting level of debt to GDP, it raises the question: can His Majesty’s Treasury continue to issue long-term index-linked debt under these conditions?

What are the longer-term implications for gilt markets?

If value for money has become more important for the DMO when assessing its funding programme, issuance should be more determined by the shape of the gilt yield curve and the overall level of yields. This should allow the DMO to regain some control over the overall shape of the gilt yield curve.

The move away from the long end of the curve should remove the supply discount that can currently be seen in the 30-year segment of the gilt market. The sharp inversion of the curve beyond 30-year yields should also lessen as the DMO should now see this part of the curve as open to issuance given its value for money criteria.

The programmatic tenders should reduce the yield differential that exists at shorter and medium maturities between the recently issued high coupon gilts and the older high coupon bonds, which trade at a premium as they often have reduced free floats owing to the Bank of England’s Asset Purchase Facility owning significant amounts of these bonds.

This should mean the yield differential between low-coupon and high-coupon bonds should stabilise and could potentially narrow. The low-coupon bonds, especially the ultra-long dated bonds, offer investors a cash-efficient way to buy duration, so these bonds will always be sought after. However, a more cost-conscious DMO may see value in supplying these bonds to the market on a more regular basis than has been seen previously. The shorter-dated bonds would probably be most at risk of this given their higher cash prices than the longer-dated gilts.

However, this would be unlikely to fundamentally alter the shape of the yield curve with the steepness of the yield curve still determined predominantly by monetary policy and the outlook for inflation.