The Pensions Regulator has set out further guidance for managing risks when using liability-driven investing (LDI). Here we summarise the guidance and suggest how pension schemes can evolve their strategy to improve resilience and efficiency.

The regulator's new guidance helps clarify minimum standards at a time when most schemes are:

- Reviewing the liquidity profile of their wider investment strategy,

- Accessing new sources of liquidity, and

- Improving governance processes for liquidity management.

In this note, we summarise the guidance and consider the implications on investment strategy for pension schemes.

Three key areas of new guidance

The Pensions Regulator has released new guidance on the practical steps trustees can take to improve the resilience of LDI portfolios to market events.

1. Market stress buffer

The regulator recommends schemes hold a minimum buffer to give them resilience against a rise in yields of at least 250bp. The aim is to allow LDI arrangements to continue to function during a period of recapitalisation, even under a wide range of market stresses.

Schemes may choose to have a market stress buffer higher than 250bp, particularly if it will take more than five days to top-up the collateral buffer.

2. Operational buffer

The regulator recommends an additional operational buffer to help keep a scheme above its market stress buffer. The operational buffer will vary in size on a day-to-day basis in response to market movements, while target levels set by schemes will depend on their governance processes for topping up the buffer and the overall liquidity profile of their wider strategy.

3. Liquidity considerations

The regulator wants pension schemes to have greater consideration of the overall liquidity of their investments, including having a plan to keep the operational buffer topped up. To achieve this, schemes should consider the composition of other liquid assets, the monitoring process, and what levels of oversight and delegation are appropriate in order to respond quickly during a crisis.

What practical steps should schemes take to meet this guidance?

1. Increase collateral buffers

Most pension schemes have already completed this first step: implementing higher levels of collateral resilience in their investment strategy, consistent with the latest regulator’s guidance on market stress and operational buffers.

2. Choose liquid assets that reduce forced-selling risk

Liquid assets used to top up the operational buffer are not all created equally – some assets will have much higher sensitivity to market movements, which can have a negative impact at times of crisis. For example, shorter-dated credit or asset-backed securities are typically less sensitive to changes in credit spreads than longer-dated assets.

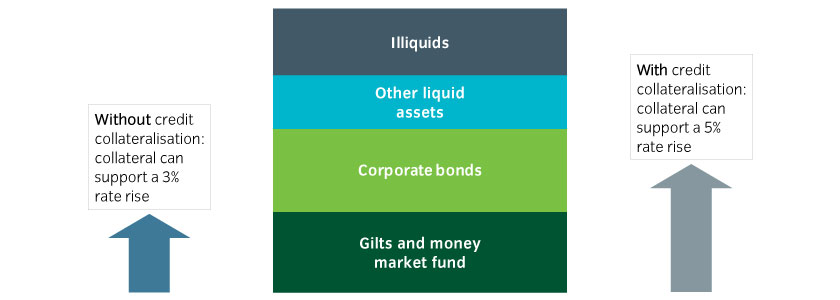

Enhanced collateral-management solutions offer the potential to improve resilience and minimise the risk of asset sales. One approach is to use investment grade corporate bonds. As well as existing roles of providing income, generating returns and contributing to interest rate hedging, corporate bonds can also be used as collateral to improve resilience (see Figure 1 below). Corporate bond collateralisation can convert corporate bonds into assets that are eligible to support a scheme’s liability hedge.

Figure 1: Using credit for collateral can improve resilience

For illustrative purposes only.

Insight cautions against waiting for exceptional circumstances to arise before trying to implement corporate bond enhancement tools, as market capacity is untested in meeting the increased appetite for credit collateralisation from pension schemes. Consequently, focus needs to be on making this capacity more reliable. Given the potential for herding behaviour, we believe credit collateralisation is best implemented pre-emptively with maturities laddered appropriately to manage roll risk (the risk that the cost of contracts rises at renewal or that renewal is not possible).

There are different implementation approaches to credit collateralisation. The most suitable will depend on a scheme’s wider position and prevailing market conditions. When managing the mix of instruments to collateralise credit, schemes should consider:

- The potential improvement in collateral resilience

- The cost of each credit collateralisation approach

- How to decide an appropriate maturity ladder and roll risk

- The scheme’s wider strategy and liquidity profile

3. Manage illiquid allocations

Many schemes face a significant headwind: high allocations to illiquid assets may limit their ability to top up the operational buffer if yields rise significantly. A survey of a sub-set of our clients in October 2022 found that over 40% held more than 30% of their total assets in illiquid assets such as private equity and infrastructure.

Schemes with large illiquid allocations may wish to consider how more liquid assets can be fully utilised. The cost of potential insurance-style options, such as credit collateralisation approaches which last for a longer period, can be balanced against the potential discount arising from selling illiquid assets.

Yet, if sized suitably, holding illiquid assets may still have an important role to play given many have an attractive risk/return profile. This is particularly the case for illiquid assets that provide contractual income and that naturally mature over the scheme’s target time horizon such that they can help to meet future cashflow requirements.

Rethinking collateral waterfalls

Pension schemes have a range of approaches to liquidity, commonly including a ‘collateral waterfall’ managed by a scheme’s LDI provider within agreed parameters. A collateral waterfall uses a mixture of assets that provide balance to the following:

- Collateral resilience

- Reducing forced-selling risk

- Return efficiency

The introduction of new liquidity-management tools, in particular credit collateralisation, opens up potential enhancements to the ability of collateral waterfalls to meet all three objectives above.

Insight can work closely with you to tailor your approach to collateral management. This may include delegating the management of certain credit collateralisation choices to Insight within an agreed framework.

FIND OUT MORE ABOUT INTEGRATED SOLUTIONS |

Most read

Fixed income

July 2025

Monthly fixed income review and outlook

Global macro, Fixed income

October 2023

Global macro research: Yield-curve inversion – an unreliable recession signal?

Global macro

July 2023

Global macro research: Asset allocation in focus

Global macro

May 2023

Ireland

Ireland