Watch Rhona Cormack, Insight’s Senior Stewardship Analyst, offer an outline of Insight’s engagement approach and activity over the last year.

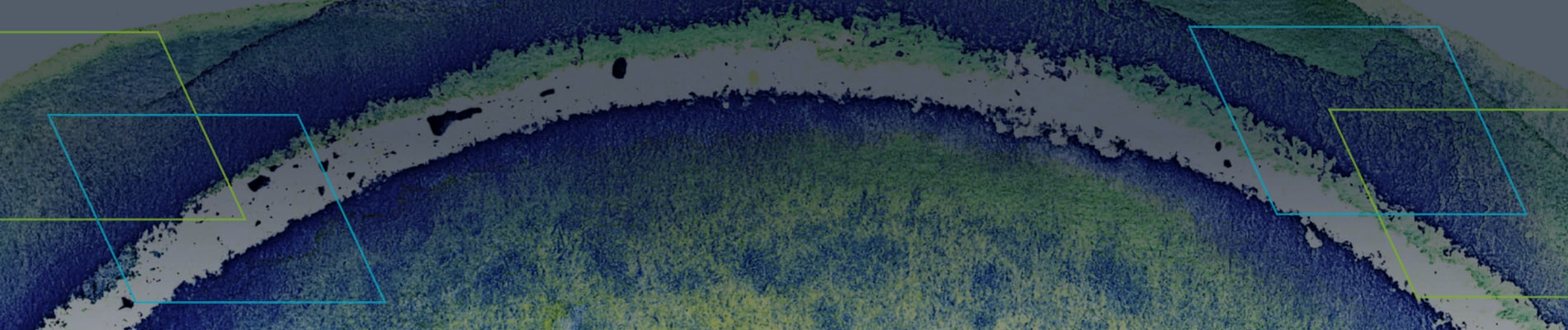

Engagement activity in 2023

In 2023, we completed over 140 dedicated ESG engagements, while the majority of the 991 broader engagements conducted by our research analysts with debt issuers also included some form of ESG dialogue.

149

dedicated ESG engagements1

991

total engagements with issuers1

61

countries including 23 emerging markets

48%

of our meetings included executive-level management

Our focus on stewardship

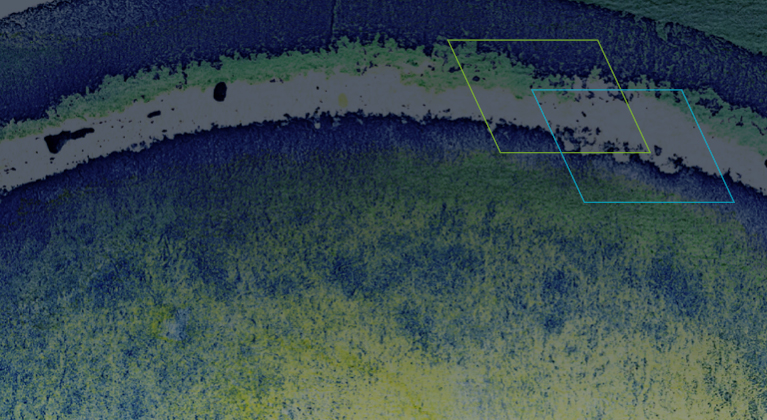

Tackling greenwashing: Insight's impact bond ratings

In 2023, Insight rated 370 unique impact bonds capturing 173 issuers – with c.26% rated red, meaning they were excluded from our Responsible Horizons strategies.

What's new?

Our 2023 Stewardship Report outlines a range of new developments and initiatives, including those outlined below.

Engaging on systemic issues

Engaging on systemic issues

Insight continued to engage extensively to support well-functioning markets, prioritising issues where we offer leading technical expertise and we have identified potentially significant implications for clients and the wider market. This included significant discussions in the UK on the future for defined benefit pension schemes, and engaging on matters of climate change policy.

Escalation to support engagements

Escalation to support engagements

We implemented a new five stage process for engagement escalation in 2023. Where progress against an engagement objective on a financially material topic lags our expectations, we may move it into our enhanced monitoring process.

New impact strategies

New impact strategies

Insight’s Responsible Horizons range has been expanded to seven strategies, with the report detailing the launch of new impact-focused strategies classified as Article 9 under the EU’s Sustainable Finance Disclosure Regulation (SFDR).