|

Green buildings: a key consideration for responsible investors

As investors prioritise sustainability-driven investments, new fonts in the battle against excess C02 emissions are commencing.

While emissions from energy production remain a primary focus, other sources of greenhouse gases are growing in prominence, in particular from buildings.

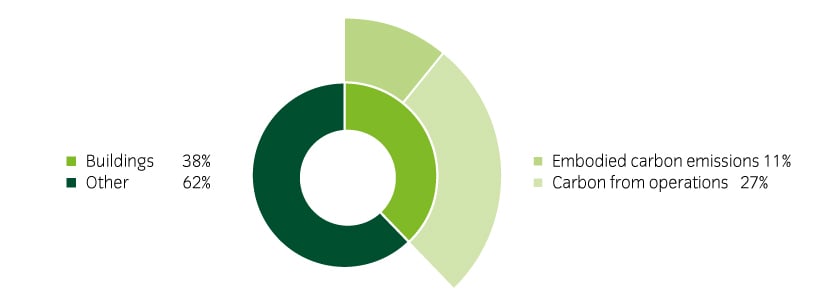

Currently, about 38% of overall global GHG emissions originate from buildings1, with 27% of emissions deriving from the operations of building2 and the remaining 11% the result of embodied carbon, the GHG emissions associated with building materials and construction (see Figure 1).

Figure 1: Buildings account for a significant proportion of global GHG emissions (% of total GHG emissions)2

Green financing: responsible investors cannot ignore green property bonds

Green financing typically involves raising capital to finance, or refinance, environmental projects. For the building sector, this means issuers can use the proceeds of green financing to enhance the sustainability of existing properties, or invest in newer, more efficient buildings, thus creating the capacity to rotate from existing, less sustainable developments.

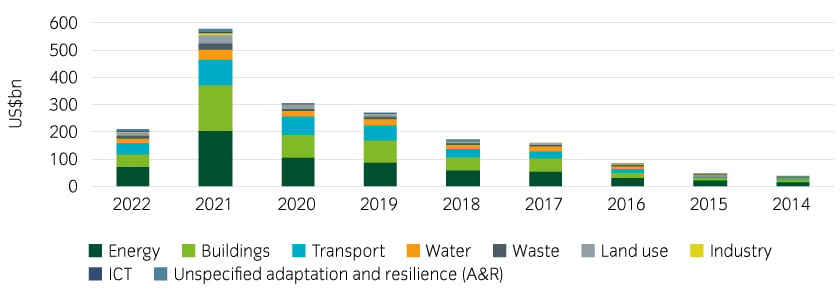

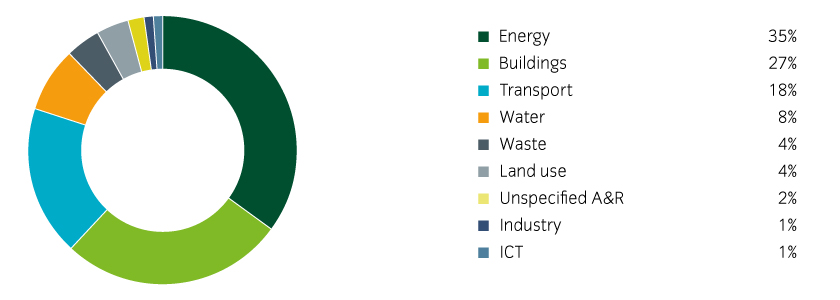

As awareness of sustainability focussed property developments has increased, demand for green finance has surged, and the supply of green bonds with ‘use of proceeds’ frameworks targeting green buildings has grown significantly.4 According to the Climate Bonds Initiative, green bonds linked to buildings could represent 40% of the green bond market over the long term.5 By monetary value, issuance of green bonds linked to green buildings approached US$166bn during 20216 (see Figure 2), while the cumulative value of green property bonds issued since 2014 amounts to US$512bn (see Figure 3), over 27% of total issuance.

Figure 2: Use of proceeds bonds issued by sector (total US$bn)6

Figure 3: Use of proceeds bonds outstanding (cumulative value by sector, US$bn)6

Defining ‘green’ is crucial

In our view, for investors seeking transparency regarding a green bond’s use of proceeds, understanding the underlying characteristics of a ‘green building’ is vital. According to the World Green Building Council a green building is “a building that in its design, construction, or operation, reduces or eliminates negative impacts, and can create positive impacts, on our climate and natural environment”.7

Beware greenwashing

Given the apparent receptiveness of investors to green bonds, considerable commercial benefits can accrue from marketing a project as green, potentially incentivising ‘greenwashing’ – exaggerated claims regarding the environmental sustainability. Consequently, several industry certification standards have arisen, designed to effectively mobilise capital to suitable investments and assure investors about any bond’s use of proceeds.

However, the relative opacity and multiplicity of the certification standards poses a risk for investors. The sheer number of attributes qualifying a building and any related bond issue as ‘green’ may lead to greenwashing. Likewise, whether the level of certification targeted by a specific bond issue is wholly appropriate for a green label is open to question, given the variety of companies involved in different building types.

Most read

Responsible investment, Fixed income

July 2022

Assessing the impact of ESG in Fixed income

Responsible investment

April 2024

Insight's Stewardship Report 2024

Fixed income, Responsible investment

January 2024

Nature-related financial risks in corporate bonds: a case study

Responsible investment

March 2022